share

In today’s highly competitive and margin-sensitive supply chain environment, financial accuracy and speed are no longer back-office concerns, they are strategic imperatives. As supply chains grow more complex, with multiple stakeholders, dynamic pricing structures, frequent adjustments, and tighter compliance requirements, organizations often struggle to maintain financial control without slowing down operations.

Many enterprises still rely on fragmented processes, manual reconciliations, and delayed financial visibility. The result is predictable: revenue leakage, delayed accruals, approval bottlenecks, and limited confidence in cost-to-serve metrics. Optimizing supply chain financials is not just about automation-it is about creating a tightly integrated, auditable, and decision-ready financial ecosystem. The key lies in moving from fragmented, spreadsheet-driven processes to an integrated, automated financial workflow that aligns seamlessly with transportation and logistics operations.

The Financial Challenge in Modern Supply Chains

Traditional supply chain financial processes often introduce delays and leakage as costs evolve faster than financial systems can capture.

Break Down in Traditional Supply Chain Financials

Supply chain financial workflows typically sit at the intersection of planning, execution, and enterprise finance. This intersection introduces several recurring challenges:

- Frequent cost adjustments driven by operational realities such as detention, fuel surcharges, and accessories

- Delayed financial visibility, with costs finalized only after execution

- Manual approvals and overrides, increasing cycle times and error risk

- Disconnected accruals and actuals, leading to period-end surprises

- Limited auditability, especially when approvals and adjustments happen across systems

Industry studies indicate that organizations with manual or semi-automated logistics financial processes can experience 2–5% revenue leakage annually due to unbilled charges, incorrect accruals, or missed adjustments. In large-scale operations, this translates into significant bottom-line impact.

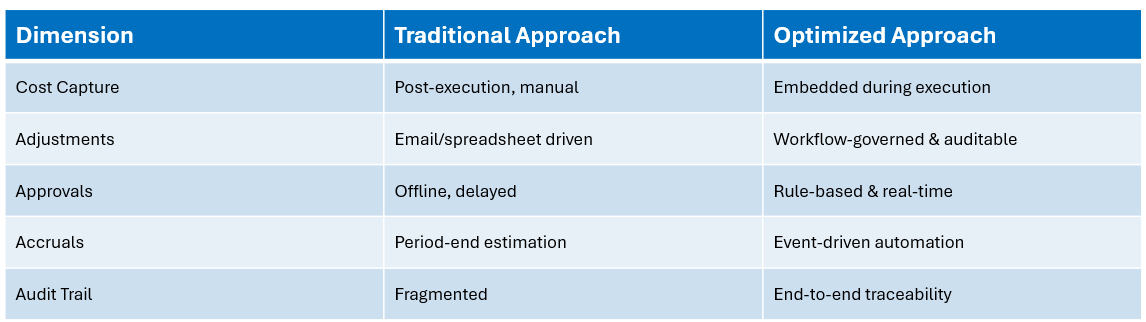

Traditional vs Optimized Supply Chain Financials

A Shift Toward Financial Orchestration

Optimizing supply chain financials requires a shift from transaction-centric processing to financial orchestration—where costs, approvals, accruals, and settlements move in a governed yet flexible flow.

At a high level, a mature financial orchestration model focuses on:

- Early cost capture during planning and execution

- Controlled flexibility for manual adjustments with full traceability

- Embedded approval workflows aligned with financial authority matrices

- Automated voucher and billing generation to reduce cycle time

- Seamless accrual and settlement integration with enterprise finance systems

Rather than treating financial processes as an afterthought, leading organizations embed financial intelligence directly into supply chain workflows.

Key Principles of Optimized Supply Chain Financials

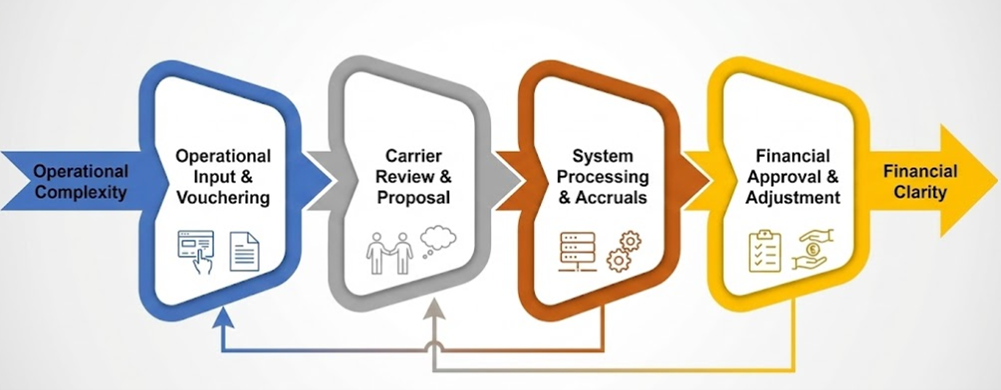

1. Financial Accuracy Without Operational Friction

Operations teams need the ability to respond to real-world exceptions—without compromising financial governance. Optimized systems allow adjustments to be proposed, reviewed, and approved within predefined rules, ensuring both agility and control.

Impact: Organizations adopting governed adjustment workflows have reported up to 30–40% reduction in invoice disputes.

Integrated Supply Chain Financial Processing Lifecycle

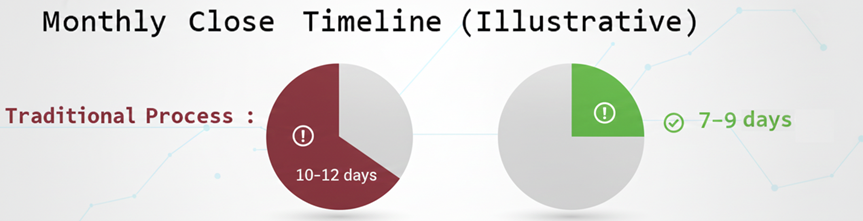

2. Faster Financial Close Cycles

Delayed cost finalization often pushes logistics expenses into subsequent accounting periods. By aligning execution events with real-time financial updates, accruals and actuals stay synchronized.

Impact: Automated accrual runs and transaction retrieval can shorten monthly close cycles by 2–3 days.

Impact on Financial Closure Timelines

3. End-to-End Visibility and Audit Readiness

Every adjustment, approval, and release should be traceable—who changed what, when, and why. This level of transparency not only supports audits but also builds trust between operations and finance teams.

Impact: Enterprises with auditable financial workflows experience up to 50% reduction in audit preparation effort.

4. Scalability for High-Volume Operations

As transaction volumes grow, manual financial handling does not scale. Optimized financial workflows are designed to handle high throughput while maintaining consistent governance.

Impact: High-volume shippers can process 3–5x more financial transactions without increasing headcount.

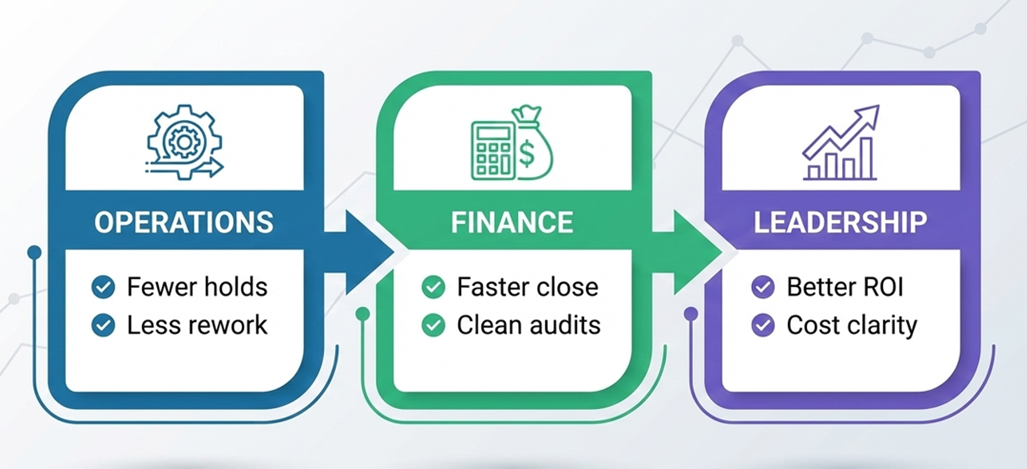

Enterprise-Wide Value Creation

Strategic Benefits Beyond Finance

Optimizing supply chain financials delivers value well beyond the finance function:

- Improved cost-to-serve insights enable smarter network and carrier decisions

- Stronger carrier relationships due to faster, more accurate settlements

- Better forecasting accuracy through aligned accruals and actuals

- Enhanced executive confidence in supply chain profitability metrics

In effect, financial optimization becomes a foundation for data-driven supply chain strategy.

Quantified Business Outcomes

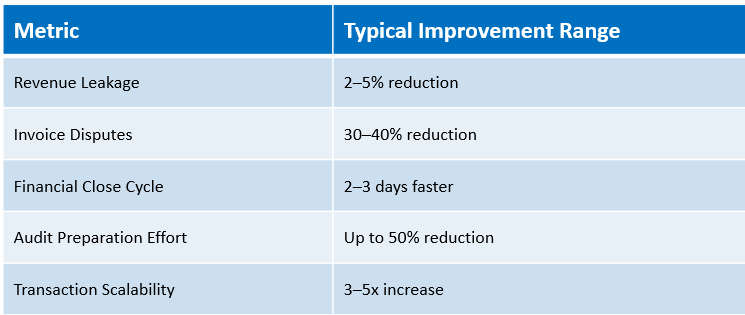

Above table represents commonly observed outcomes when organizations move from manual or fragmented logistics financial processes to an integrated, workflow-driven financial orchestration model.

The Road Ahead

Supply chain excellence is no longer defined solely by on-time delivery or transportation cost reduction. Financial precision, speed, and transparency are now equally critical performance dimensions. Organizations that invest in optimizing their supply chain financial workflows position themselves to reduce leakage, accelerate close cycles, and unlock actionable insights from their logistics spend.

As supply chains continue to evolve, the winners will be those who treat financial orchestration not as a support function—but as a strategic capability.